The Policy Pundit’s Hippocratic Oath: Do No Harm

By Dr. Robert E. Wright

At their best, abolitionists and antislavery activists are essentially policy pundits because they want governments to change various policies that impact the costs and benefits associated with enslaving others.

As Julia O’Connell Davidson reminds us in her Modern Slavery: The Margins of Freedom (2015), antislavery activists have to be cognizant of their potential impact on the world. Specifically, she charges that “though the new abolitionists tend to deliver their message with the righteously indignant fervour that is usually associated with movements of religious and political dissent, the ‘truth’ that they speak to power is actually very palatable to governments of affluent liberal states, and to the corporate world” (p. 12). Her critique of the modern antislavery movement ultimately founders, however, because it stems from economic sociology, a critique of neoclassical economics that would be more convincing if it made accurate predictions about the real world. Like other Marxist offshoots, economic sociology is better at damning others than presenting anything of value to those who would improve the real world.

Davidson’s point about unintended consequences, however, is very well taken indeed. Fixing even the seemingly smallest problems is amazingly difficult. Take, for example, the problem of debt. As Bales, Batstone, Kara, Skinner, and others have shown, enslavers often use debt as a means of subjecting people to de facto slavery because while slavery is illegal almost everywhere, collecting debts is not.

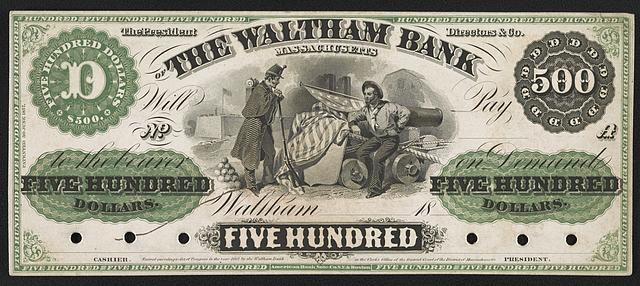

Enslavers sometimes use high rates of interest to ensure that debtors can never repay their debts, keeping them in thrall (you know that thrall is an old Scandinavian term for slave, right?) as long as the enslavers see fit. Some people believe that high rates of interest in and of themselves are inherently bad things, so a professor at my school (Augustana University in South Dakota) got up a petition to put a 36% APR usury cap on the ballot this fall.

While capping interest rates sounds like a great idea that antislavery activists such as myself should support, usury caps are actually poor policy as I explained in a recent op ed in the local newspaper. In the past, usury caps have only raised effective borrowing rates for the poor, who are smart enough to figure out, by comparing absolute dollars rather than rates, when it is beneficial for them to borrow and when it is not.

As I show in the op ed, it is perfectly rational to borrow small sums for short terms at seemingly very high rates of interest (four digit APR) in order to avoid late payment penalties, bounced check fees, and so forth when the total dollar cost of borrowing is less than the penalty. Mandating some arbitrary APR therefore hurts the very people that the usury cap is supposed to help. I believe that, like doctors, policy pundits should not cause harm to their “patients,” so I have to reject the usury cap recommendation.

In addition to not harming the presumed beneficiaries, good policies are often carefully targeted to the actual problem. So a better policy from the standpoint of antislavery would be to forbid employers from earning a profit on loans made to reputed employees or limiting such loans to some fraction of the employee’s average net pay. That way, employers who want to help out their employees by giving them an advance can do so, but they can’t lawfully turn the loan into a mechanism of peonage or other forms of exploitation.

Finally, new policies should be tracked over time and improved or rescinded if they do not have the intended effect. To work around prohibitions against lending to their employees, for example, determined enslavers might set up shills to make the loans on their behalf. If lawmakers had not initially anticipated that response, they can upon review expand the law to include entities owned or controlled by the employer.

No law or policy is ever perfect but by studying history we can at least avoid repeating past mistakes such as usury strictures. Just as importantly, by asking the views of those impacted by proposed policies we can also avoid doing harm to those we would like to help.

Dr. Robert E. Wright is the Nef Family Chair of Political Economy at Augustana University and the author of seventeen books. He is also a Board Member of Historians Against Slavery, and has written for Barron’s, The Chronicle of Higher Education, Forbes.com, and other prominent publications.